Introduction

Treasury Management is defined as “The management of the Authority’s investments and cash flows, its banking, money market and capital market transactions; the effective control of the risks associated with those activities; and the pursuit of optimum performance consistent with those risks.”

The Local Government Act 2003 (the Act), and supporting Regulations, requires the Authority to “have regard to” the CIPFA Prudential Code and the CIPFA Treasury Management Code of Practice to set Prudential and Treasury Indicators for the next three years to ensure that the Authority’s capital investment plans are affordable, prudent, and sustainable. The Code also requires the Authority to approve a treasury management strategy before the start of each financial year. The authority also adheres to investment guidance issued by the then Ministry of Housing, Communities and Local Government (MHCLG).

The definition of investments in the codes is wide raging and includes nontreasury investments for example loans to third parties and the holding of property to make a profit. Where these are held a separate strategy is required. However, it is not considered that the Combined Fire Authority hold any such assets and it does not propose to engage in any such investments in 2024/25.

Treasury Management Strategy for 2024/25

This Strategy Statement has been prepared in accordance with the CIPFA Treasury Management Code of Practice. Accordingly, the Lancashire Combined

Fire Authority's Treasury Management Strategy will be approved by the full Authority, and there will also be a mid-year and a year-end outturn report presented to the Resources Committee. In addition, there will be monitoring and review reports to members in the event of any changes to Treasury

Management policies or practices. The aim of these reporting arrangements is to ensure that those with ultimate responsibility for the treasury management function appreciate fully the implications of treasury management policies and activities, and that those implementing policies and executing transactions have properly fulfilled their responsibilities regarding delegation and reporting.

This Authority has adopted the following reporting arrangements in accordance with the requirements of the revised Code:

Table 1 Treasury Management reporting arrangements

Area of Responsibility | Committee/ Officer | Frequency |

|---|

Treasury Management Policy Statement | Resources Committee/Authority | Annually |

Treasury Management Strategy / Annual Investment Strategy / MRP policy – scrutiny and approval | Resources Committee/ Authority | Annually before the start of the year |

1

Area of Responsibility | Committee/ Officer | Frequency |

|---|

Treasury Management mid-year report, | Resources Committee | Mid-year |

Treasury Management Strategy / Annual Investment Strategy / MRP policy – updates or revisions at other times | Resources Committee | As required |

Annual Treasury Management Outturn Report | Resources Committee/ Authority | Annually by 30 September after the end of the year |

Treasury Management Monitoring Reports | Director of Corporate Services | Quarterly |

Treasury Management Practices | Director of Corporate Services | Annually |

The Treasury Management Strategy, covers the following aspects of the Treasury Management function:

Prudential Indicators which will provide a controlling framework for the capital expenditure and treasury management activities of the Authority.

Current Long-term debt and investments.

Prospects for interest rates.

The Borrowing Strategy.

The Investment Strategy.

Policy on borrowing in advance of need.

Setting the Treasury Management Strategy for 2024/25

In setting the treasury management strategy the following factors need to be considered as they may have a strong influence over the strategy adopted:

economic position and forecasts.

Interest rate forecasts.

the current structure of the investment and debt portfolio.

Future Capital Programme and underlying cash forecasts.

Economic background:

The impact on the UK from higher interest rates and inflation, a weakening economic outlook, an uncertain political climate due to an upcoming general election, together with war in Ukraine and the Middle East, will be major influences on the Authority’s treasury management strategy for 2024/25.

The Bank of England (BoE) increased Bank Rate to 5.25% in August 2023, before maintaining this level in September and then again in November.

The November quarterly Monetary Policy Report (MPR) forecast a prolonged period of weak Gross Domestic Product (GDP) growth with the potential for a mild contraction due to ongoing weak economic activity. The outlook for

Consumer Price Index (CPI) inflation was deemed to be highly uncertain, with near-term risks to CPI falling to the 2% target coming from potential energy price increases, strong domestic wage growth and persistence in price-setting.

The UK economy grew by 0.2% between April and June 2023. The BoE forecasts GDP will likely stagnate in Q3 but increase modestly by 0.1% in Q4, a deterioration in the outlook compared to the August MPR. The BoE forecasts that higher interest rates will constrain GDP growth, which will remain weak over the entire forecast horizon.

Office for National Statistics (ONS) figures showed CPI inflation was 6.7% in September 2023, unchanged from the previous month but above the 6.6% expected. Core CPI inflation fell to 6.1% from 6.2%, in line with predictions. Looking ahead, using the interest rate path implied by financial markets the BoE expects CPI inflation to continue falling, declining to around 4% by the end of calendar 2023 but taking until early 2025 to reach the 2% target and then falling below target during the second half 2025 and into 2026.

Interest rate Forecast

Many commentators consider that with inflation and wage growth falling, the Bank Rate has peaked at 5.25%. It is anticipated that the Bank of England’s Monetary Policy Committee will cut rates in the medium term to stimulate the UK economy but will be reluctant to do so until it is sure there will be no lingering second-round effects. Both the forward markets and the County Councils treasury management adviser are anticipating cuts to start by mid-2024 and that they will fall to around 3% by September 2026.

Current Treasury Portfolio Position

At the 31 December 2023, the debt and investments balances were: Table 2 Debt and Investments balances

Debt | Principal | % |

£m |

Fixed rate loans from the Public Works Loan Board | 2.000 | 100 |

Variable rate loans | - | - |

Total | 2.000 | 100 |

Investments | | |

Variable rate investments with Lancashire County Council | 7.695 | 25.0 |

Fixed rate investments | 23.500 | 75.0 |

Total | 31.195 | 100 |

The level of investments represents the Authority’s cumulative surplus on the General Fund, the balances on other cash-backed earmarked reserves and a cash-flow balance generated by a surplus of creditors over debtors and by grant receipts in advance of payments. There is a net investment figure of £29.195m.

Borrowing and Investment Requirement

In the medium term, LCFA borrows for capital purposes only. The underlying need to borrow for capital purposes is measured by the Capital Financing Requirement (CFR), while usable reserves and working capital are the underlying resources available for investment. The table below compares the estimated CFR to the debt which currently exists, this gives an indication of the borrowing required. It also shows the estimated resources available for investment. An option is to use these balances to finance the expenditure rather than investing, often referred to as internal borrowing. The table gives an indication of the minimum borrowing or investment requirement through the period.

The CFR forecast includes the impact of the latest forecast of the funding of the Capital Programme which currently assumes that there will be no borrowing until 2026/27. A voluntary Minimum Revenue Provision (MRP) was made in 2019/20 to take the future loans element of the MRP to nil.

Table 3 Borrowing/Investment Need

| 31/03/2024 | 31/03/2025 | 31/03/2026 | 31/03/2027 |

| £m | £m | £m | £m |

Capital Financing Requirement | 12.351 | 11.868 | 17.496 | 32.248 |

Less long-term liabilities (PFI and finance leases) | -12.351 | -11.868 | -11.339 | -10.760 |

Less external borrowing | -2.000 | -2.000 | -2.000 | -2.000 |

Borrowing requirement | -2.000 | -2.000 | 4.157 | 19.488 |

| | | | |

Reserves and working capital | 31.558 | 30.012 | 22.316 | 11.214 |

(Borrowing)/Investment need | 33.558 | 32.012 | 18.159 | -8.274 |

CIPFA’s Prudential Code for Capital Finance in Local Authorities recommends that the Authority’s total debt should be lower than its highest forecast CFR over the next three years. However, the table above shows that the level of loans was above the CFR at 31/3/23. This was the result of the Authority adopting a policy of setting aside additional MRP to generate the cash to repay loans either on maturity or as an early repayment.

The table above indicates that rather than having a need for borrowing it is estimated that the authority has an underlying need to invest until 2025/26 although the available balances are forecast to reduce. Based on the latest capital programme the authority will have a borrowing requirement in 2026/27.

Although the Authority does not have plans for new borrowing until 2026/27 it does currently hold £2.0m of loans as part of its strategy for funding previous years' capital programmes.

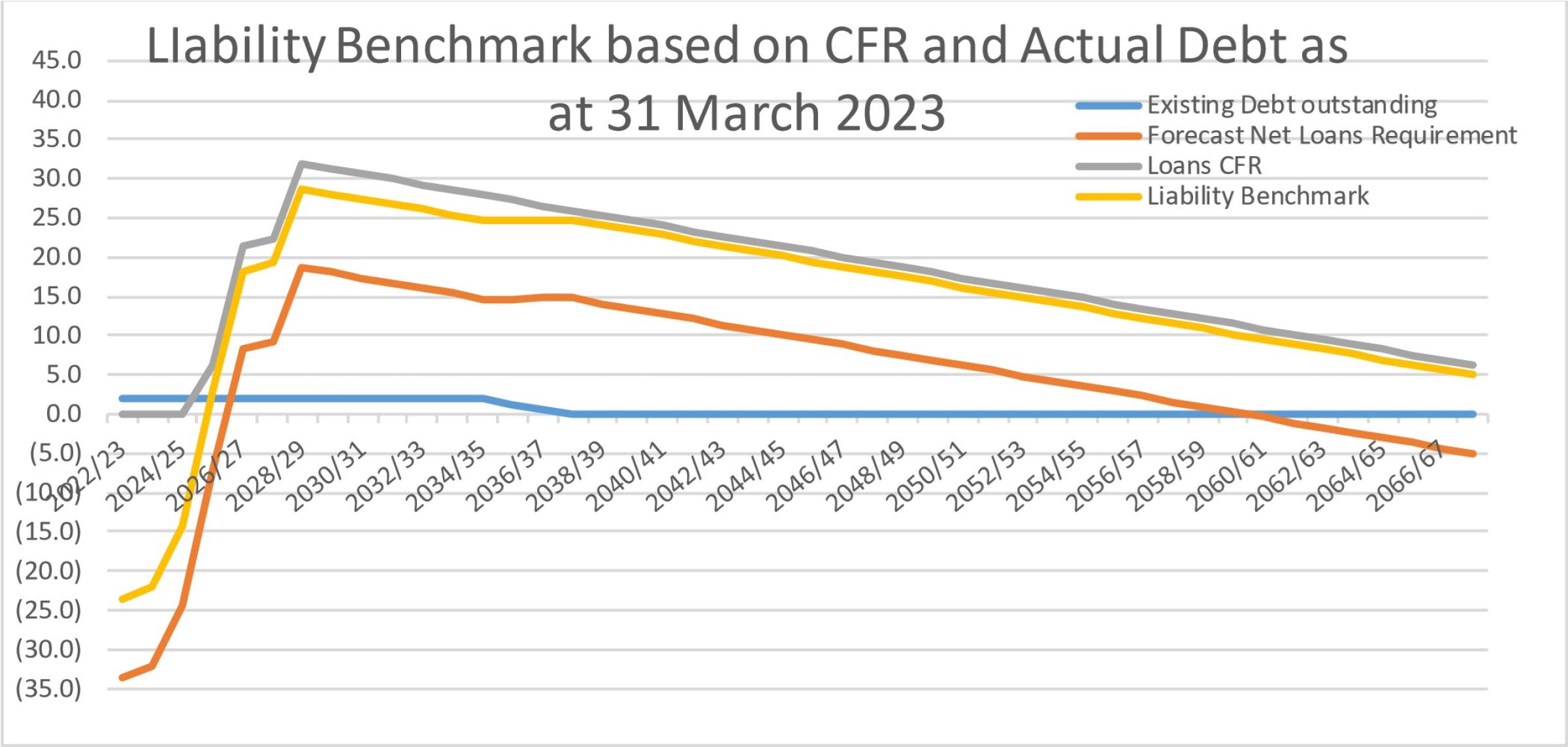

Liability benchmark

The liability benchmark is an indicator required by the CIPFA Code. It looks to compare the Council’s actual borrowing requirements against an alternative strategy, a liability benchmark, which shows the minimum level of borrowing.

This assumes the same forecasts as the table above, but that cash and investment balances are kept to a minimum level of £10m at each year-end to maintain sufficient liquidity but minimise credit risk. In addition, it reflects the latest Capital Programme information which shows a borrowing requirement from 2026/27 onwards. The liability benchmark is shown in the graph below: Graph 1 showing Liability Benchmark and Borrowing Scenarios

The benchmark shows that from 2026/27 there is likely to be a long-term requirement to borrow but that this does not necessarily have to be at the level of the loans CFR, which represents the maximum borrowing. The borrowing requirement is also reducing over time which may influence the length and type of borrowing to be taken.

Borrowing Strategy

The draft Capital Programme implies there may be a requirement to use borrowing to fund the capital programme in the later years. At this stage it is extremely unlikely that borrowing will be required in 2024/25. However, it is still best practice to approve a borrowing strategy and a policy on borrowing in advance of need. In considering a borrowing strategy the Authority needs to make provision to borrow short term to cover unexpected cash flow shortages or to cover any change in the financing of its Capital Programme.

In the past, the Authority has raised all its long-term borrowing from the Public Works Loan Board, but if long term borrowing was required other sources of finance, such as local authority loans, and bank loans, would be investigated that may be available at more favourable rates.

Short-term borrowing if required would most likely be taken from other local authorities.

Therefore, the approved sources of long-term and short-term borrowing are:

Public Works Loan Board.

UK local authorities.

Any institution approved for investments.

Any other bank or building society authorised by the Prudential Regulation Authority to operate in the UK.

UK public and private sector pension funds.

Policy on Borrowing in Advance of Need

In line with the Prudential Code the Authority will not borrow purely to profit from the investment of the extra sums borrowed. However advance borrowing may be taken if it is considered that current rates are more favourable than future rates and that this advantage outweighs the cost of carrying advance borrowing. Any decision to borrow in advance will be considered carefully to ensure value for money can be demonstrated and that the Authority can ensure the security of such funds and relationships.

In determining whether borrowing will be undertaken in advance of need the authority will:

Ensure that there is a clear link between the capital programme and the maturity profile of the existing debt portfolio which supports the need to take funding in advance of need.

Ensure the on-going revenue liabilities created, and the implications for future plans and budgets have been considered.

Evaluate the economic and market factors that might influence the manner and timing of any decision to borrow.

Consider the merits and demerits of alternative forms of funding.

Consider the alternative interest rate bases available, the most appropriate periods to fund and repayment profiles to use.

Debt Restructuring

The Authorities debt has arisen because of prior years' capital investment decisions. It has not taken any new borrowing out since 2007 as it has been utilising cash balances to pay off debt as it matures, or when deemed appropriate with the authority making early payment of debt. The anticipated holding of debt at 31 March 2024 is £2.0m. All the debt is from the Public Works Loans Board (PWLB) and is all at fixed rates of interest and is repayable on maturity. The table below shows the maturity profile and interest rate applicable on these:

Table 4 Outstanding Loans

Loan Amount | Maturity Date | Interest rate |

|---|

£650k | December 2035 | 4.49% |

£650k | June 2036 | 4.49% |

£700k | June 2037 | 4.48% |

(Note, this debt was taken out in 2007 when the base rate was 5.75% and when the Authority was earning 5.84% return on its investments.)

If the loans were to be repaid early there would be an early repayment (premium) charge. Previous reports on treasury management activities have reported that the premium and the potential loss of investment income have been greater than the savings made on the interest payments therefore it has not been considered financially beneficial to repay the loans especially with the potential for increased interest rates. However, at the 30 September the estimated premium charge to repay the three loans was minimal although rates and the premium change daily. To offset the net savings on repaying the loans it was estimated that future interest on investments over the remaining period of the loans would need to be 4.5%. If it is estimated that investment interest rates will be lower than this figure, then it may be beneficial to repay the loans.

Investment Strategy

On 31 December 2023, the Authority held £31.195m invested funds, representing income received in advance of expenditure plus existing balances and reserves. During the year, the Authority’s investment balance has ranged between £49m and £26m. The variation arises principally due to the timing of the receipt of government grants. It is anticipated that there will be reduced cash levels in the forthcoming year, due to a drawdown in reserves to finance capital expenditure.

Both the CIPFA Code and government guidance require the Authority to invest its funds prudently, and to have regard to the security and liquidity of its investments before seeking the highest rate of return, or yield. The Authority’s objective when investing money is to strike an appropriate balance between risk and return, minimising the risk of incurring losses from defaults and the risk receiving unsuitably low investment income.

Therefore, in line with the guidance the Treasury Management Strategy is developed to ensure the Fire Authority will only use very high-quality counterparties for investments.

The Authority may invest its surplus funds with any of the counterparties in the table below, subject to the cash and time limits shown.

Table 5 Investment Counterparties

Counterparty | Cash limit | Rating / Time limit |

|---|

Banks and other organisations and securities whose lowest published long-term credit rating from Fitch, Moody’s and Standard & Poor’s is: | £5m each | AAA / 5 years AA+ / 3 years AA / 2 years AA- / 2 years |

Call Accounts with banks and other organisations with minimum A- credit rating | £10m | next day |

Call Account with Lancashire County Council | unlimited | next day |

UK Central Government (irrespective of credit rating) | unlimited | 50 years |

UK Local Authorities (irrespective of credit rating) | £5m each | 10 years |

Secured Bond Funds AA rating and WAL not more than 3 years | £5m each | n/a |

Secured Bond Funds AAA rated and WAL not more than 5 years | £5m each | n/a |

Allowable bond funds are defined by credit rating and Weighted Average Life (WAL). Investing in senior secured bonds backed by collateral provides a protection against bail-in. Although the average life of the securities within the fund will be either 3 or 5 years, funds can be redeemed within 2 days of request but in general these should be seen as longer-term investments.

Regarding the risk of investing with another local authority, only a very few authorities have their own credit rating, but those that do are the same or one notch below the UK Government reflecting the fact that they are quasi-Government institutions. On the whole credit ratings are seen as unnecessary by the sector because the statutory and prudential framework within which the authorities operate is amongst the strongest in the world. In addition, any lender to a local authority has protection, under statute, by way of a first charge on the revenues of that authority. No local authority has ever defaulted to date, and this also may be an indication of security. However, when the UK credit rating by the rating agencies has been downgraded those local authorities with a rating saw a reduction in their ratings. Therefore, consideration has been given to reducing the risk associated with the investment with other local authorities. Arlingclose, the County Council's Treasury Management advisor, state they are "comfortable with clients making loans to UK local authorities for periods up to two years, subject to this meeting their approved strategy. For periods longer than two years we recommend that additional due diligence is undertaken prior to a loan being made." On this basis it is proposed that the investments to local authorities are limited as follows:

Table 6 Investment Limits with Local Authorities

| Maximum individual investment (£m) | Maximum total investment (£m) | Maximum period |

|---|

Up to 2 years | 5 | 40 | 2 years |

Over 2 years | 5 | 25 | 10 years |

The investment in LCC as part of the call account arrangement is excluded from the above limits. The balance on this account is dependent upon short term cash flows and therefore does not have a limit.

Whilst the investment strategy has been amended to allow greater flexibility with investments any decision as to whether to utilise this facility will be made based on an assessment of risk and reward undertaken jointly between the Director of Corporate Services and LCC Treasury Management Team, and consideration of this forms part of the on-going meetings that take place throughout the year.

In respect of banks taxpayers will no longer bail-out failed banks instead the required funds will be paid by equity investors and depositors. Local authorities' deposits will be at risk and consequently although currently available within the policy it is unlikely that long term unsecured term deposits will be used at the present time.

Currently, all of the Authority's investments are with other local authorities.

The Authority currently has access to a call (instant access) account with a local authority, which pays bank base rate, this is currently 5.25%. Each working day the balance on the Authority's current account is invested to ensure that the interest received on surplus balances is maximised.

In addition, longer term loans have been placed with UK local authorities to enhance the interest earned. To this end at the following investments are already impacting 2024/25.

Table 7 Current Investments

Start Date | End Date | Principal | Rate | Interest 2024/25 |

|---|

17/10/2023 | 15/10/2024 | £5,000,000 | 5.55% | £150,534 |

20/11/2023 | 18/11/2024 | £5,000,000 | 5.85% | £185,918 |

12/12/2023 | 12/09/2024 | £5,000,000 | 5.60% | £126,575 |

14/12/2023 | 12/12/2024 | £3,500,000 | 5.05% | £123,967 |

24/02/2024 | 21/02/2025 | £5,000,000 | 5.55% | £245,616 |

Consideration is given fixing further investments if the maturity fits with estimated cash flows and the rate is considered to be attractive. This will continue to be reviewed. Suggested rates payable by other local authorities indicated:

Table 8 Indicative Interest Rates on Investments with other Local Authorities

3-month investment | 5.43 – 5.63% |

6-month investment | 5.40 – 5.60% |

12-month investment | 5.36 – 5.56% |

3-year investment | 4.33 - 4.53% |

4-year investment | 4.15 - 4.35% |

The overall combined amount of interest earned on Fixed/Call balances as at 31 December 2023 is £1.173m on an average balance of £36.151m at an annualised rate of 4.31%. This is less than the benchmark 7-day London Interbank Bid Rate (LIBID) rate which averages a yield of 4.89% over the same period.

In addition to the above the authority uses NatWest for its operational banking. Balances retained in NatWest are very low, usually less than £5,000. However, if required monies are retained at NatWest this would be in addition to the limits set out above.

Minimum Revenue Provision (MRP)

Under Local Authority Accounting arrangements, the Authority is required to set aside a sum of money each year to reduce the overall level of debt. This sum is known as the minimum revenue provision (MRP).

The Authority will assess their MRP for 2024/25 in accordance with guidance issued by the Secretary of State under section 21(1A) of the Local Government Act 2003.

The Authority made a voluntary MRP in 2019/20 and it is anticipated that the MRP on loans will be nil in 2024/25 this will be the case until capital expenditure is financed by borrowing.

Whilst the Authority has no unsupported borrowing, nor has any plans to take out any unsupported borrowing in 2024/25 it is prudent to approve a policy relating to the MRP that would apply if circumstances changed. As such in accordance with guidelines, the MRP on any future unsupported borrowing will be calculated using the Asset Life Method. This will be based on a straightforward straight – line calculation to set an equal charge to revenue over the estimated life of the asset. Estimated life periods will be determined under delegated powers. To the extent that expenditure is not on the creation of an asset and is of a type that is subject to estimated life periods that are referred to in the guidance, these periods will generally be adopted by the Authority. However, the Authority reserves the right to determine useful life periods and prudent MRP in exceptional circumstances where the recommendations of the guidance would not be appropriate.

As some types of capital expenditure incurred by the Authority are not capable of being related to an individual asset, asset lives will be assessed on a basis which most reasonably reflects the anticipated period of benefit that arises from the expenditure. Also, whatever type of expenditure is involved, it will be grouped together in a manner which reflects the nature of the main component of expenditure and will only be divided up in cases where there are two or more major components with substantially different useful economic lives.

Assets held under a PFI contracts and finance leases form part of the Balance Sheet. This has increased the overall capital financing requirement and results in an MRP charge being required. The government guidance permits a prudent MRP to equate to the amount charged to revenue under the contract to repay the liability. In terms of the PFI schemes this charge forms part of the payment due to the PFI contractor.

Revenue Budget

The capital financing budget currently shows that income received exceeds expenditure. This excludes the PFI and Finance lease payments, which are included in other budgets. Based on the Strategy outlined above then the proposed budget for capital financing is:

Table 9 Capital Financing Charges Included in Revenue Budget

| 2023/24 | 2024/25 | 2025/26 | 2026/27 |

|---|

| £m | £m | £m | £m |

Interest payable | 0.090 | 0.090 | 0.398 | 1.170 |

MRP | 0.000 | 0.000 | 0.000 | 0.123 |

Interest receivable | (1.300) | (1.050) | (0.650) | (0.650) |

Net budget | (1.210) | (0.960) | (0.252) | (0.643) |

Prudential Indicators for 2023/24 to 2026/27 in respect of the Combined Fire Authority's Treasury Management Activities.

In accordance with its statutory duty and with the requirements of the Prudential Code for Capital Finance and the CIPFA Code for Treasury Management, the Combined Fire Authority produces each year a set of prudential indicators which regulate and control its treasury management activities.

The following table sets out the debt and investment-related indicators which provide the framework for the Authority’s proposed borrowing and lending activities over the coming three years. These indicators will also be approved by members as part of the Capital Programme approval process along with other capital expenditure-related indicators but need to be reaffirmed and approved as part of this Treasury Management Strategy.

It should be noted that contained within the external debt limits, there are allowances for outstanding liabilities in respect of the PFI schemes and leases. However, accounting standards are changing in relation to recording leases. In effect more leases are likely to be included on the balance sheet and therefore will be included against the other long term liabilities indicators. At this stage work is on-going to quantify the impact of the change and therefore the other long term liabilities limits may be subject to change.

Treasury Management Prudential Indicators

| 2023/24 £m | 2024/25 £m | 2025/26 £m | 2026/27 £m |

|---|

Adoption of the Revised CIPFA Code of Practice on Treasury Management | | | | |

Authorised limit for external debt : | | | | |

Borrowing | 4.000 | 4.000 | 15.000 | 30.000 |

Other long-term liabilities | 30.000 | 30.000 | 30.000 | 30.000 |

Total | 34.000 | 34.000 | 45.000 | 60.000 |

| 2023/24 £m | 2024/25 £m | 2025/26 £m | 2026/27 £m |

|---|

Operational boundary for external debt | | | | |

Borrowing | 3.000 | 3.000 | 10.000 | 25.000 |

Other long-term liabilities | 16.000 | 16.000 | 15.000 | 15.000 |

Total | 19.000 | 19.000 | 25.000 | 43.000 |

| 2023/24 | 2024/25 | 2025/26 | 2026/27 |

|---|

Upper limit for fixed interest rate exposure | | | | |

Upper limit of borrowing at fixed rates | 100% | 100% | 100% | 100% |

Upper limit of investments at fixed rates | 100% | 100% | 100% | 100% |

| 2023/24 | 2024/25 | 2025/26 | 2026/27 |

|---|

Upper limit for variable rate exposure | | | | |

Upper limit of borrowing at fixed rates | 50% | 50% | 50% | 50% |

Upper limit of investments at fixed rates | 100% | 100% | 100% | 100% |

| 2023/24 £m | 2024/25 £m | 2025/26 £m | 2026/27 £m |

|---|

Upper limit for total principal sums invested for over 364 days (per maturity date) | 25.000 | 25.000 | 25.000 | 25.000 |

Maturity structure of Debt | Upper Limit % | Lower Limit % |

|---|

Under 12 months | 100 | - |

12 months and within 24 months | 50 | - |

24 months and within 5 years | 50 | - |

5 years and within 10 years | 75 | - |

10 years and above | 100 | - |

Estimated Capital Expenditure

| 2022/23 actual | 2023/24 forecast | 2024/25 budget | 2025/26 budget |

|---|

| £m | £m | £m | £m |

Capital Expenditure | 1.635 | 7.598 | 10.196 | 20.259 |

Proportion of Financing Costs to Net Revenue Stream

| 2022/23 actual | 2023/24 budget | 2024/25 budget | 2025/26 budget |

|---|

Financing costs (£m) | -0.747 | -1.210 | -0.960 | -0.252 |

Proportion of net revenue stream | -1.18% | -1.77% | -1.28% | -0.33% |

Appendix 1

Treasury Management Policy Statement

The Fire Authority adopts the key recommendations of CIPFA’s Treasury Management in the Public Services: Code of Practice (the Code), as described in Section 5 of the Code.

Accordingly, the Authority will create and maintain, as the cornerstones for effective treasury management:

A treasury management policy statement stating the policies, objectives, and approach to risk management of its treasury management activities.

Suitable Treasury Management Practices (TMPs), setting out the manner in which the Authority will seek to achieve those policies and objectives, and prescribing how it will manage and control those activities.

The Authority delegates responsibility for the implementation and monitoring of its treasury management policies and practices to the Resources Committee and for the execution and administration of treasury management decisions to the Director of Corporate Services, who will act in accordance with the organisation’s policy statement and TMPs, IMPs and CIPFA’s Standard of Professional Practice on treasury management.

The Authority nominates the Resources Committee to be responsible for ensuring effective scrutiny of the treasury management strategy and policies.

Definition

The Authority defines its treasury management activities as: the management of the Authority’s investments and cash flows, its banking, money market and capital market transactions; the effective control of the risks associated with those activities; and the pursuit of optimum performance consistent with those risks.

Risk management

The Fire Authority regards the successful identification, monitoring, and control of risk to be the prime criteria by which the effectiveness of its treasury management activities will be measured. Accordingly, the analysis and reporting of treasury management activities will focus on their risk implications for the organisation, and any financial instruments entered into to manage these risks.

Value for money

The Fire Authority acknowledges that effective treasury management will provide support towards the achievement of its business and service objectives. It is therefore committed to the principles of achieving value for money in treasury management, and to employing suitable comprehensive performance measurement techniques, within the context of effective risk management.

Borrowing policy

The Fire Authority greatly values revenue budget stability and will therefore borrow the majority of its long-term funding needs at long-term fixed rates of interest. However, short term and variable rate loans may be borrowed to either offset short-term and variable rate investments or to produce revenue savings. The Authority will also constantly evaluate debt restructuring opportunities of the existing portfolio.

The Fire Authority will set an affordable borrowing limit each year in compliance with the Local Government Act 2003 and will have regard to the CIPFA Prudential Code for Capital Finance in Local Authorities when setting that limit. It will also set limits on its exposure to changes in interest rates and limits on the maturity structure of its borrowing in the treasury management strategy report each year.

Investment policy

The Fire Authority’s primary objectives for the investment of its surplus funds are to protect the principal sums invested from loss, and to ensure adequate liquidity so that funds are available for expenditure when needed. The generation of investment income to support the provision of local authority services is an important, but secondary, objective.

The Fire Authority will have regard to the then Ministry of Housing, Communities and Local Government Guidance on Local Government Investments. It will approve an Investment Strategy each year as part of the Treasury Management Strategy. The strategy will set criteria to determine suitable organisations with which cash may be invested, limits on the maximum duration of such investments and limits on the amount of cash that may be invested with any one organisation.